Overwhelmingly Opposed

An Analysis of Public and 955 Organization, Expert, and Public Official Comments on the IRS’s 501(c)(4) Rulemaking

By Matt Nese and Kelsey Drapkin

Less than seven months after news broke that the Internal Revenue Service had been singling out conservative-leaning groups’ applications for 501(c)(4) tax-exempt status for higher scrutiny, the Service proposed new regulations to further govern the permissible activities of these groups, using a newly-created and broadly-defined definition known as “candidate-related political activity.” In the midst of multiple ongoing federal investigations into the targeting scandal, the Service announced the Notice of Proposed Rulemaking on the Friday of Thanksgiving week 2013, commencing a 90-day public comment period that closed on February 27, 2014. During this period, a record-breaking number of concerned citizens, organizations, nonprofit tax lawyers, and public officials voiced their opinions on the proposed rulemaking, the vast majority of which were overwhelmingly critical.

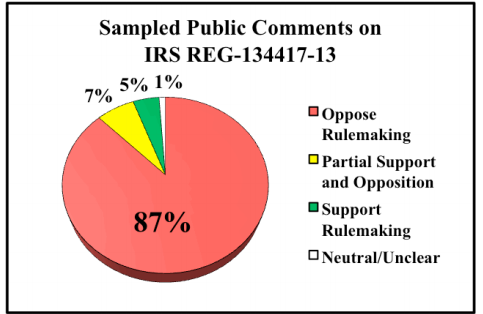

In this report, we sampled the record 143,852 public comments by reading and categorizing every 100th comment received by the IRS as either “oppose rulemaking,” “partial support and opposition,” “support rulemaking,” or “neutral/unclear.” We also tracked every comment submitted by an organization, expert, and public official by searching for comments posted with attachments, and categorized these submissions as either “oppose rulemaking,” “oppose portions of rulemaking,” or “support rulemaking.”

An analysis of the comments received by the IRS shows that 87% of public comments sampled wrote to the IRS in opposition to this rulemaking, and 94% of those sampled either oppose or partially oppose the proposal. An analysis of comments from organizations, experts, and public officials found that 97% of these commenters submitted statements to the IRS in varying degrees of opposition to the rulemaking, with 64% of organizations, experts, and public officials firmly in opposition. The comments received by the IRS were not limited to one interest group or political party, but rather were from citizens and organizations of all political persuasions, tax statuses, and geographical locations.

Though a variety of reasons were mentioned by commenters, ten main reasons were routinely cited by those commenting in opposition to the regulations: (1) the definition of “candidate-related political activity” (CRPA) is too broad and overreaching; (2) the definition of “candidate” is also overbroad; (3) the proposed rules make it difficult for organizations to have any mentions of a candidate for office on their websites in specified periods before an election; (4) volunteer activity could be considered CRPA; (5) political speech will be chilled and voters will not receive informative information in a timely manner; (6) groups may have to disclose their membership and donor lists to maintain their tax-exempt status, triggering the potential for harassment; (7) 501(c)(3) charities and 501(c)(4) social welfare organizations will be subject to conflicting definitions of political campaign activity; (8) political and advocacy activities are an important and traditional function of 501(c)(4) organizations; (9) the statutory requirement that 501(c)(4)s must be operated “exclusively for the promotion of social welfare” includes a range of activities, including political campaign intervention; and (10) this regulation will not have any impact whatsoever on revenue collection, even though it is a regulation promulgated by the IRS.

Considering the record number of comments generated and the expansive societal cross-section represented in both the public and organizational, expert, and public official comments, which were overwhelmingly in opposition to the proposed rulemaking, the IRS would be best served to reject – or at least re-write – the unworkable, burdensome, and speech-chilling regulations.

https://ifs-site.mysitebuild.com/wp-content/uploads/2014/07/2014-07-08_Issue-Review_Nese-And-Drapkin_Overwhelmingly-Opposed.pdf

Background

Beginning in March of 2010, the Internal Revenue Service began scrutinizing groups applying for 501(c)(4) tax-exempt status using politically biased criteria.[1] Those groups with names containing the words “Tea Party” or “patriot,” and later, groups with goals as broad as “teaching about the Constitution,” were singled out for greater IRS scrutiny.[2] Reports surfaced of the illegal targeting in May of 2013, and were followed by multiple federal investigations into the Agency’s practices. After first claiming the targeting had never occurred, the IRS then alleged it was the result of a rogue group of agents from the Cincinnati office – a claim that has since been debunked by Congressional investigators.[3]

On November 29, 2013, in a supposed effort to clarify the permissible activities of 501(c)(4) organizations less than seven months after the Internal Revenue Service revealed that the Agency had been targeting conservative organizations for added scrutiny and delaying their applications for tax-exempt status, the IRS proposed expansive new rules for regulating the political activity of 501(c)(4) organizations.

The rulemaking, purported to “provide guidance to tax-exempt social welfare organizations on political activities related to candidates that will not be considered to promote social welfare,”[4] restricts activities that the Agency deems as excessive political activity by tax-exempt 501(c)(4) groups. It was later revealed by House Ways and Means Committee Chairman Dave Camp (R-MI) during a House Ways and Means Oversight Subcommittee hearing with newly installed IRS Commissioner John Koskinen that a June 2012 email exchange between a Treasury Department attorney and IRS officials in the Tax Exempt Organizations Division, including former Exempt Organizations Division Director Lois Lerner, referenced “off-plan” conversations regarding 501(c)(4) groups.[5] Camp noted that “off-plan” meant “hidden from the public.”[6] Committee interviews with IRS officials found that the rules were being planned as early as 2011, long before the targeting scandal became public.

The proposed rules introduce an expansive definition of “candidate-related political activity,” which includes activities that had never before been deemed “political,” including, but not limited to, voter-registration drives and the production of nonpartisan voter guides. This definition could potentially jeopardize the tax-exempt status of many nonprofit groups on both sides of the political spectrum.

Unsurprisingly, a diverse array of groups from across the political spectrum – such as the Alliance for Justice, American Civil Liberties Union, American Motorcyclist Association, The Heritage Foundation, the National Association for the Advancement of Colored People, the National Association of Manufacturers, and the Solar Energy Industries Association – along with over 950 prominent organizations, experts, and public officials, and tens of thousands of individuals filed comments with the IRS arguing against the proposed rulemaking, either in whole or in part, based on its dire effects on the political speech rights of societally important nonprofit groups. Even groups that would not be affected by the proposed rulemaking like the U.S. Chamber of Commerce, a 501(c)(6) trade association, and a coalition of labor unions representing millions of individuals, organized under Section 501(c)(5) of the Internal Revenue Code, filed comments with the IRS in opposition to the proposed rulemaking. Some organizations, including the Institute for Free Speech, also commented on how the proposed regulations violate the Paperwork Reduction Act of 1995, which requires all federal agencies to accurately notify the public about the associated paperwork burdens of any proposed rulemaking.

Predictably, these overbroad and unworkable rules were met with skepticism and pointed opposition by many on Capitol Hill. Efforts were made in both the House by Representative Camp (H.R. 3865[7]) and the Senate by Senators Jeff Flake (R-AZ) and Pat Roberts (R-KS) (S. 2011[8]) to – at the very least – delay the regulations from taking effect until the ongoing investigations into the IRS targeting scandal are completed. Camp characterized the rules as “a blatant attempt to legalize and institutionalize targeting by the IRS…designed to put conservative groups out of business. It is no wonder the IRS tried to develop this rule behind closed doors and out of the public’s view.”[9] In support of S. 2011, Senate Minority Leader Mitch McConnell said the proposed regulations “would actually entrench and encourage the harassment of groups that dare to speak up and engage in the conversation.”[10]

Public comments on the proposed rulemaking were accepted by the IRS for a 90-day period, lasting from November 29, 2013 through February 27, 2014. A remarkable 143,852 comments on the proposal were publicly available as of July 8, 2014, a number current IRS Commissioner John Koskinen indicated was the highest on record that the Agency has received on a Notice of Proposed Rulemaking.[11]

This report will shed light on just how dramatically widespread both public, organizational, expert, and public official opposition is to this IRS rulemaking. In the following sections, we analyze our public comment sample as well as the organizational, expert, and public official comments on the proposal and highlight ten prominent reasons given by commenters in opposition to the proposed rules. What follows is illuminating in expressing just how many individuals, organizations, nonprofit tax lawyers, and public officials of all political leanings and differing corporate forms oppose this proposed rule. The impressive and bipartisan opposition to this rulemaking further bolsters our contention that the proposal should be withdrawn and re-worked with sensitivity to the First Amendment rights of all social welfare organizations

Public Comment Sample Analysis

The Institute for Free Speech performed an analysis of the comments and found that the vast majority of submissions – a remarkable 87% – oppose the new regulations, with only 5% of public commenters favoring the regulation. The remaining 7% voiced partial support for the proposed rulemaking while noting opposition to varying aspects of the proposal. 1% of the comments sampled were neutral about the rulemaking or otherwise indistinguishable. Impressively, nearly 4 in 10 comments sampled (38%) were unique comments submitted by concerned citizens who were motivated to comment on this rulemaking, not because of urging by any organization, but out of sheer concern over the ramifications of the rulemaking.

To gauge public opinion of comments filed on IRS REG-134417-13, we analyzed a 1% sample of the 143,852 total comments submitted to the IRS during the 90-day public comment period from November 29, 2013 to February 27, 2014. Our sample accounts for “comments posted” to www.regulations.gov as of July 8, 2014.

Those who oppose the rulemaking typically cited concerns over IRS involvement in free speech, the impact the rules would have on nonprofit organizations, or partisan abuse of the agency. Favorable comments voiced general support for expanding campaign finance disclosure and limiting political advocacy activity by tax-exempt organizations, but often included requests for amendments to the proposed rule to protect nonpartisan activity.

https://ifs-site.mysitebuild.com/wp-content/uploads/2014/07/2014-07-08_IFS-One-Pager_Wachob_IRS-Rulemaking-Public-Comment-Analysis.pdf

Organization, Expert, and Public Official Comment Analysis

Altogether, 955 organizations, experts, and public officials on the local, state, and federal level submitted substantive comments on the proposed rulemaking. This number includes organizations from across the tax code – 501(c)(3) charitable organizations, 501(c)(4) social welfare groups, 501(c)(5) labor unions, and 501(c)(6) trade associations – as well as experts, such as nonprofit tax lawyers and certified public accountants, and public officials, like members of Congress and current and former FEC Commissioners. Our totals account for each individual organizational, expert, or public official signee onto a comment submission submitted by an organization, expert, or public official. According to our analysis, 611 commenters (64%) expressed opposition to the proposed regulations, 314 (33%) voiced partial support for the regulations with serious caveats about provisions contained in the current rulemaking, and just 30 (3%) offered support for the regulations, as proposed. Taken together, an astounding 97% of comments analyzed oppose the rulemaking in its current form.

Organizations, experts, and public officials who commented in opposition to the regulations focused mainly on its threat to free speech, the potential impact of the regulations on the vitality of nonprofit organizations, and concerns about the political connection of the rulemaking to the yet-to-be-resolved IRS targeting scandal involving conservative-leaning organizations. About one-third of those who commented commended the IRS for taking steps to rework the current rules and, in some cases, to decrease the alleged influence of politically active social welfare organizations. However, these commenters had great concerns regarding the effects of the rulemaking on inarguably nonpartisan activities such as voter registration drives or candidate forums. These organizations and experts generally advocated for a stricter differentiation between partisan and nonpartisan activities in the final draft of the regulations. The comments supporting the proposed regulation as written maintained that the rulemaking’s proposed definition of “candidate-related political activity” was a necessary change, reasoning that those groups that no longer fit the 501(c)(4) definition will not lose tax-exempt status, but rather will have to file as a 527 group and disclose their supporters. Those who support the regulations – typically organizations and experts advocating for greater regulation of political speech – see the disclosure of donor lists due to this change of tax status as a positive byproduct of the proposed rules.

https://ifs-site.mysitebuild.com/wp-content/uploads/2014/07/2014-07-08_IFS-One-Pager_Drapkin_IRS-Rulemaking-Organizational-Expert-And-Public-Official-Comment-Analysis.pdf

Arguments in Opposition to Notice of Proposed Rulemaking

While a broad swath of arguments were made in opposition to the proposed regulations, there were ten main reasons repeatedly cited by those commenting to the IRS. The most prominently made arguments in opposition to the rulemaking by public and organizational commenters are listed below, in no particular order:

I. The definition of “candidate-related political activity” (CRPA) is too broad and overreaching in that it includes, but is not limited to, nonpartisan activities such as:

-

- Voter registration and Get-out-the-Vote (GOTV) Efforts: All voter registration and get-out-the-vote activities would be classified as CRPA.

- Hosting Nonpartisan Candidate Events: Hosting a candidate debate within 30 days of a primary or 60 days of a general election would be classified as CRPA if attended by one or more candidates. For decades, 501(c)(3) charities have been able to conduct these activities, provided that the events were nonpartisan. Nonetheless, the IRS appears to believe that these events do not “promote social welfare” when hosted by a 501(c)(4) social welfare organization. The regulations could also cause charitable events such as informational conferences and galas – key parts of educating the public about public policy – to be counted as CRPA. If a candidate attends an event, even unannounced, a 501(c)(4) could reasonably fear that the event could then be counted as CRPA. Even sending an officer of a 501(c)(4) to a different organization’s gala may be counted as “political activity” if a candidate happens to appear.

- Public Communications: A public communication distributed within 30 days of a primary or 60 days of a general election that contains the name of a candidate is considered CRPA, even if no political stance is taken in the material.

II. The definition of “candidate” is also overbroad, such that commenting on virtually any federal officeholder in any capacity could be classified as CRPA. This would include individuals who have simply been mentioned as possible officeholders. Worse, legislation that bears the name of a candidate could be considered as mentioning the candidate (e.g. McCain-Feingold or Dodd-Frank). This expansive definition could convert an enormous range of issue speech into CRPA without any necessary connection to campaign activity on a specific candidate.

III. The proposed rules make it difficult for organizations to leave records of officeholder votes, public statements, and any mentions of a candidate for office on their websites during specified time periods before an election. Any information containing a candidate’s name that is viewable on an organization’s website during the 30 and 60-day periods before an election may be considered CRPA regardless of the content’s posting date. Practically speaking, this means an organization would likely have to spend countless hours scrubbing its website for any content – even that which may have been created years ago, but is still live on the group’s website – that mentions a candidate, or accept complex recordkeeping burdens to ensure the group remains under CRPA limits. The American Civil Liberties Union’s comment argues that much of this category of documents is “part of our workaday legislative analysis and advocacy; it has nothing to do with attempting to influence the outcome of any particular election.”[12]

IV. The regulations would also include volunteer activity as CRPA. The proposed rulemaking provides no indication as to how volunteer activity would be calculated (though tracking hours has been mentioned as one option), creating a practical and logistical nightmare for organizations, particularly smaller ones, who would have to account for their volunteers’ activities in order to maintain their tax-exempt status.

V. As a result of the issues highlighted in I – IV, the proposed regulations would chill political speech and prevent voters from receiving valuable, informative information in a timely manner.

VI. The regulations could force groups wishing to continue nonpartisan political activities while maintaining a tax-exempt status to refile under other sections of the tax code – namely Section 527 – which would require disclosure of groups’ membership and donor lists, creating the potential for harassment, threats, and vandalism by those who support politically unpopular causes.

VII. The proposed rulemaking provides differing definitions of political campaign activity for 501(c)(3) tax-deductible charities and 501(c)(4) social welfare organizations, for which donors may not take a tax deduction. Two sets of definitions of “political activity” may create confusion in the regulated tax-exempt community, especially for smaller organizations without funding to retain legal counsel. This is not to say the proposed regulations should also be applied to 501(c)(3)s, but rather that the far-reaching proposed definition of CRPA for 501(c)(4)s should be rejected for both types of groups.

VIII. 501(c)(4)s are not “charities.” Political work by these organizations is in line with their traditional role as advocacy organizations, lobbying on issues of civic importance on behalf of their members and the public. The tax code contains at least 30 different categories of nonprofits. What we think of as “charities” are typically organized under Section 501(c)(3). That section exists for “charitable” and “religious” organizations, and it is where one finds organizations such as churches, the American Cancer Society, and the American Red Cross. Section 501(c)(4) of the tax code is traditionally reserved for advocacy organizations: The National Rifle Association and the Brady Campaign to Prevent Gun Violence as well as the National Right to Life Committee and Planned Parenthood Action Fund, and so on. All of these groups are longstanding, societally important organizations that would have their traditional informational and advocacy activities significantly curbed by this proposed rulemaking.

IX. The statutory requirement that 501(c)(4)s must be operated “exclusively for the promotion of social welfare” includes a wide variety of activities, including political campaign intervention. While Section 501(c)(3) of the tax code specifically bars those charitable organizations from engaging in political activity, no such statutory prohibition exists for Section 501(c)(4) organizations. Furthermore, while Section 501(c)(4) states that it applies to organizations operating exclusively for the promotion of “social welfare,” the statute does not then define “social welfare.” In lieu of guidance, the IRS was given the discretionary power to interpret the statute, and for half a century, the Service has considered at least some political campaign activity to be consistent with operation “exclusively for the promotion of social welfare.” As a result, the 501(c)(4) category has always been the home of political advocacy groups. In a democratic society, nonpartisan get-out-the-vote drives, voter registration, voter education, and meet-the-candidates nights – all of which will be limited by the IRS’s proposed rules – are activities that can be reasonably characterized as supporting social welfare. Additionally, political campaign intervention activities also support such groups’ advocacy missions.

X. The regulation will not have any significant impact, one way or the other, on revenue collection, as 501(c)(4) organizations do not receive tax breaks. Contributions to these organizations are not tax deductible, and the tax liability of existing 501(c)(4)s wouldn’t significantly change if they were reclassified as political committees. Since this rulemaking isn’t about taxes, it seems to be more about a desire on behalf of those favoring greater regulation of political speech to forcibly compel the disclosure of private information about donors to social welfare organizations and ultimately to chill these groups’ political speech.

Conclusion

The proposed rule would upset more than 50 years of settled law and practice by defining many nonpartisan activities as CRPA, limiting the ability of certain tax-exempt nonprofits – organized under Section 501(c)(4) of the Internal Revenue Code – to conduct a multitude of nonpartisan voter registration and voter education efforts and advocacy activities.

Given these problems with the proposed regulation, it’s unsurprising that a remarkable 87% of public comments sampled oppose this rulemaking, and that 97% of organizations, experts, and public officials who commented oppose the rulemaking in its current form, with 64% of those commenters opposing it outright. These numbers are even more impressive in light of the fact that this rulemaking set an IRS record with close to 144,000 comments received from concerned citizens and organizations spanning the political spectrum.

The rulemaking is opposed by an overwhelming majority of those who posted the record-breaking number of public comments, representing citizens and organizations from all strata of society. The bipartisan and widespread opposition exposed many flaws in the rulemaking, including the overly-broad definitions of “candidate-related political activity” and “candidate” and the implications thereof, the potential for existing organizations to be required to refile under a tax status that would require the disclosure of their member and donor lists, the confusion that would result from differing definitions of “political activity” between 501(c)(3)s and 501(c)(4)s, and major questions as to why the agency responsible for collecting federal revenue has any role in regulating political speech. Overall, the proposed regulation received very little support, and the IRS would be wise to take note by rejecting this rulemaking and reworking it with sensitivity to the First Amendment speech rights of all social welfare organizations.

Methodology

To gauge public opinion of comments filed on IRS REG-134417-13, we analyzed a 1% sample of the 143,852 total comments submitted to the IRS during the 90-day public comment period from November 29, 2013 to February 27, 2014, and includes “comments posted” to www.regulations.gov as of July 8, 2014. Our sample is large, producing a 1.7% margin of error with 95% confidence. Regulations.gov provides exportable spreadsheets containing all public comments on rulemakings proposed by participating federal agencies, such as the IRS. We downloaded all public comments on IRS REG-134417-13, sorted them by the date they were received by the IRS, and selected every 100th comment for our sample. Each comment in the sample was then read and categorized as either “oppose rulemaking,” “partial support and opposition,” “support rulemaking,” or “neutral/unclear.” Additionally, we tracked whether the comments were original or copies of form letter or petition comments sent out by organizations.

To analyze comments from organizations, experts, and public officials on IRS REG-134417-13, we used the exportable spreadsheets of all public comments on rulemakings proposed by federal agencies, such as the IRS, on Regulations.gov. During the 90-day public comment period from November 29, 2013 to February 27, 2014, we downloaded the total available public comments submitted to the IRS on IRS REG-134417-13 on a daily basis. Our analysis takes into account the 143,852 “comments posted” to Regulations.gov as of July 8, 2014. Furthermore, our totals account for each individual organizational, expert, or public official signee onto a comment submission. For example, we count the number of signees onto a letter, rather than counting a sign-on letter itself as one organizational submission, in order to properly account for the number of organizations, experts, and public officials registering an opinion on the rulemaking. Each comment was sorted by whether it had an attachment, as nearly all substantive organizational comments were submitted in the form of a Microsoft Word or PDF attachment. All comments in this form were read and analyzed, and each one originating from an organization was categorized as either “oppose rulemaking,” “oppose portions of rulemaking,” or “support rulemaking.” In some cases, comments with PDF attachments were submitted by individuals. These comments were excluded from our analysis, unless the individual was an elected or appointed official or an expert on election law, tax law, or compliance, such as a current or former Federal Election Commission Commissioner, nonprofit tax lawyer, law professor, or certified public accountant. As a check, we cross-referenced our organizational, expert, and public official comment compilation with that of Public Citizen, to ensure that all comments compiled by Public Citizen are included in this analysis.

Read the full report here. Read the public comment sample analysis here. Read the analysis of comments from organizations, experts, and public officials here.

[1] J. Russell George, “Inappropriate Criteria Were Used to Identify Tax-Exempt Applications for Review,” Treasury Inspector General for Tax Administration. Retrieved on July 8, 2014. Available at: http://www.treasury.gov/tigta/auditreports/2013reports/201310053fr.pdf (May 14, 2013).

[2] Ibid.

[3] Mark Tapscott, “New IRS emails describe Washington direction of Tea Party targeting efforts,” The Washington Examiner. Retrieved on July 8, 2014. Available at: http://washingtonexaminer.com/new-irs-emails-describe-washington-direction-of-tea-party-targeting-efforts/article/2548426 (May 14, 2014).

[4] “Guidance for Tax-Exempt Social Welfare Organizations on Candidate-Related Political Activities,” Internal Revenue Service. Retrieved on July 8, 2014. Available at: http://www.regulations.gov/#!documentDetail;D=IRS-2013-0038-0001 (November 29, 2013).

[5] “Obama’s IRS ‘Confusion,’” The Wall Street Journal. Retrieved on July 8, 2014. Available at: http://online.wsj.com/news/articles/SB10001424052702304181204579365161576171176 (February 5, 2014).

[6] Ibid.

[7] U.S. Representative Dave Camp, “H.R. 3865: Stop Targeting of Political Beliefs by the IRS Act of 2014,” 113th Congress of the United States. Retrieved on July 8, 2014. Available at: http://www.gpo.gov/fdsys/pkg/BILLS-113hr3865pcs/pdf/BILLS-113hr3865pcs.pdf (March 3, 2014).

[8] U.S Senator Jeff Flake, “S. 2011: Stop Targeting of Political Beliefs by the IRS Act of 2014,” 113th Congress of the United States. Retrieved on July 8, 2014. Available at: http://www.gpo.gov/fdsys/pkg/BILLS-113s2011is/pdf/BILLS-113s2011is.pdf (February 11, 2014).

[9] U.S. Representative Dave Camp, “Ways and Means Committee Votes to Block IRS Regulations Designed to Put Conservative Groups Out of Business,” U.S. House of Representatives Committee on Ways and Means. Retrieved on July 8, 2014. Available at: http://waysandmeans.house.gov/news/documentsingle.aspx?DocumentID=369601 (February 11, 2014).

[10] Stephanie Condon, “Republicans ratchet up scrutiny of the IRS,” CBS News. Retrieved on July 8, 2014. Available at: http://www.cbsnews.com/news/republicans-ratchet-up-scrutiny-of-the-irs/ (February 12, 2014).

[11] “GOP leaders urge new IRS boss to scrap rule they claim would muzzle free speech,” Fox News. Retrieved on July 8, 2014. Available at: http://www.foxnews.com/politics/2014/02/06/gop-leaders-urge-new-irs-boss-to-scrap-rule-claim-would-muzzle-free-speech/ (February 6, 2014).

[12] Laura W. Murphy and Gabriel Rottman, “Comments on Draft Guidance for Tax-Exempt Social Welfare Organizations on Candidate-Related Political Activities,” American Civil Liberties Union. Retrieved on July 8, 2014. Available at: https://ifs-site.mysitebuild.com/wp-content/uploads/2014/02/2-4-14-ACLU-Comments-to-IRS.pdf (February 4, 2014), p. 7.